131

เครื่

องชี้

ภาวะเศรษฐกิ

จไทย พ.ศ. 2562

หน้

า

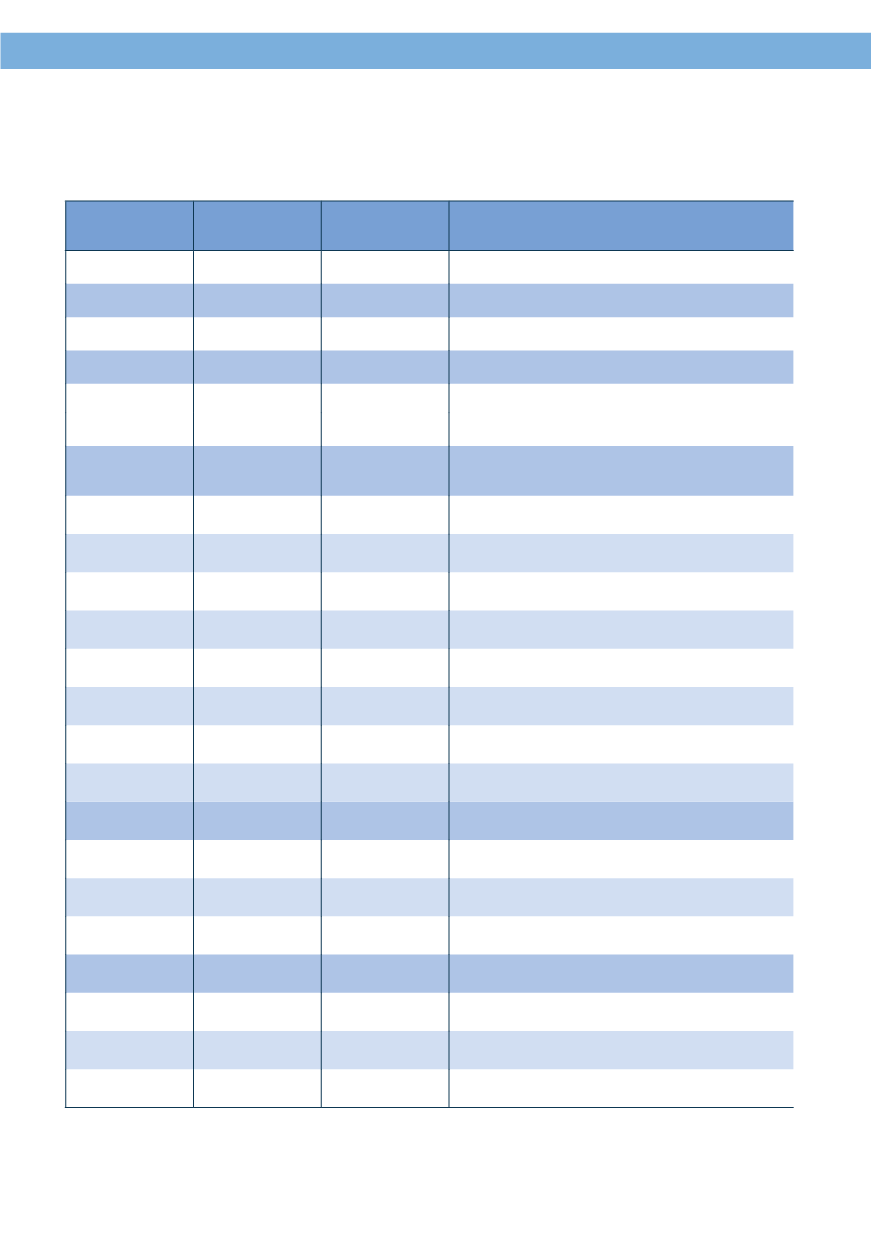

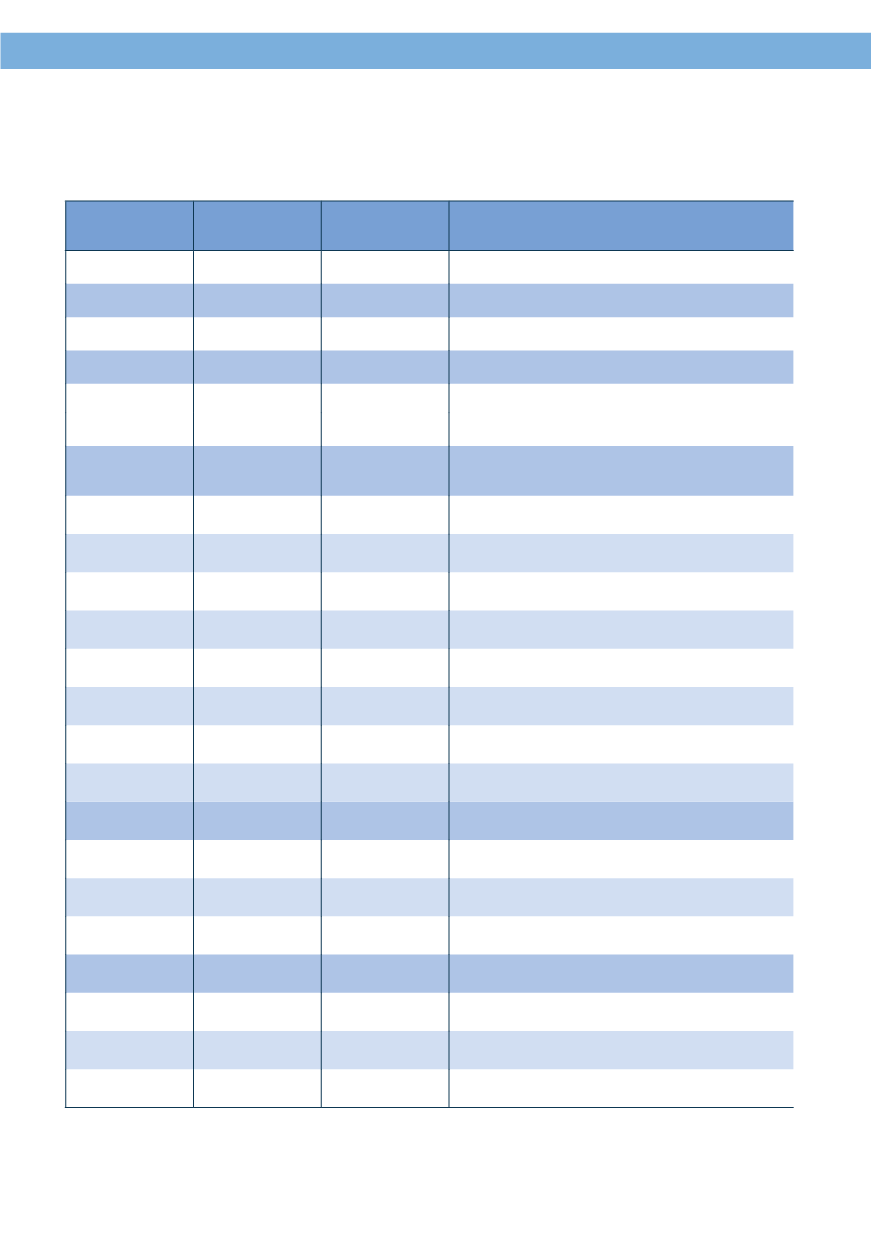

Note: 1/ Interrest Rates Used for Retail Customers. The Figures have been Quoted by Bangkok Bank,

KrungThai Bank, The Siam Commercial Bank, Kasikorn Bank and Bank of Ayudhya)

Source: Bank of Thailand

2559 (2016)

2560 (2017)

2561 (2018)

Items

1.50

1.50

1.75 End of Day Policy Rate

1.45

1.45

1.57 Interbank Overnight Lending Rates (Average)

1.35 - 1.52

1.40 - 1.53

1.40 - 2.00 Min - Max

End of Day Liquidity Adjustment Window

2.00

2.00

2.25 Lending Facility

1.00

1.00

1.25 Borrowing Facility

Financial institutions Interest Rate

of Commercial banks

1/

Min - Max

17.62 - 23.10 18.00 - 23.10 18.00 - 23.10 Loan rates (Ceiling rates):

6.25 - 6.60

6.03 - 6.60

6.03 - 6.60 MLR (Minimum Lending Rate)

7.62 - 7.70

7.12 - 7.37

7.12 - 7.37 MRR (Minimum Retail Rate)

7.12 - 7.38

6.87 - 7.20

6.87 - 7.20 MOR (Minimum Overdraft Rate)

0.30 - 0.63

0.30 - 0.63

0.30 - 0.63 Savings Deposits

0.90 - 1.00

0.90 - 1.00

0.90 - 1.00 Time Deposits 3 Months

1.15 - 1.35

1.15 - 1.35

1.15 - 1.35 Time Deposits 6 Months

1.30 - 1.50

1.30 - 1.50

1.30 - 1.50 Time Deposits 12 Months

External interest Rates US

1.15

1.90

2.86 Discount Rate US

3.64

4.39

5.35 Prime Rate US

0.65

1.40

2.36 Federal Funds

London Interbank Offered Rate (LIBOR)

0.98

1.61

2.79

3 Months

1.31

1.78

2.89

6 Months

1.67

2.05

3.08

12 Months